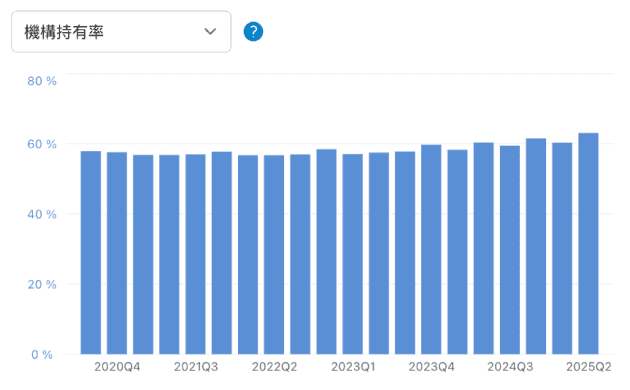

Skk holdings limitedSKK.US Institutions

US StockIndustrials

(No presentation for SKK)

SKK Whale Interest Reference Factors

Browsing restrictions can be lifted for a fee.

SKK Fund Flows

Browsing restrictions can be lifted for a fee.

SKK Insider Transactions

Prominent Inst. Holdings of SKK

Browsing restrictions can be lifted for a fee.